ĐỒ BÓNG CHUYỀNXem thêm

- Áo bóng chuyền cao cấp nam nữ chính hãng

- Giày bóng chuyền chính hãng

- Phụ kiện bóng chuyền: Lưới, trụ bóng truyền

- Quả bóng chuyền chính hãng giá rẻ

ĐỒ BÓNG ĐÁXem thêm

- Áo bóng đá giá rẻ đẹp mới nhất 2019-2020

- Áo lót bóng đá

- Áo tập bóng đá

- Đồ thủ môn

- Giày bóng đá

- Phụ kiện bóng đá

- Quả bóng đá

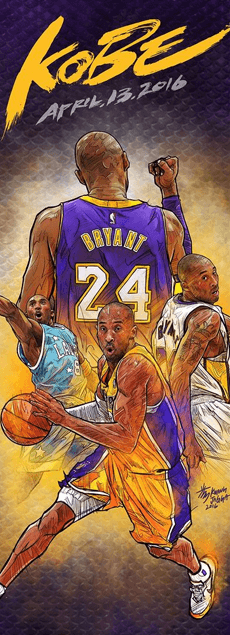

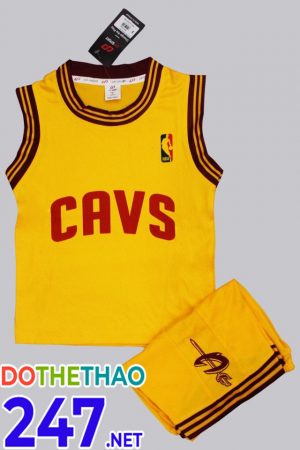

ĐỒ BÓNG RỔXem thêm